An encouraging yet not fully fulfilling 2024, a bright prospective yet tumultuous 2025

Looking through the crystal ball

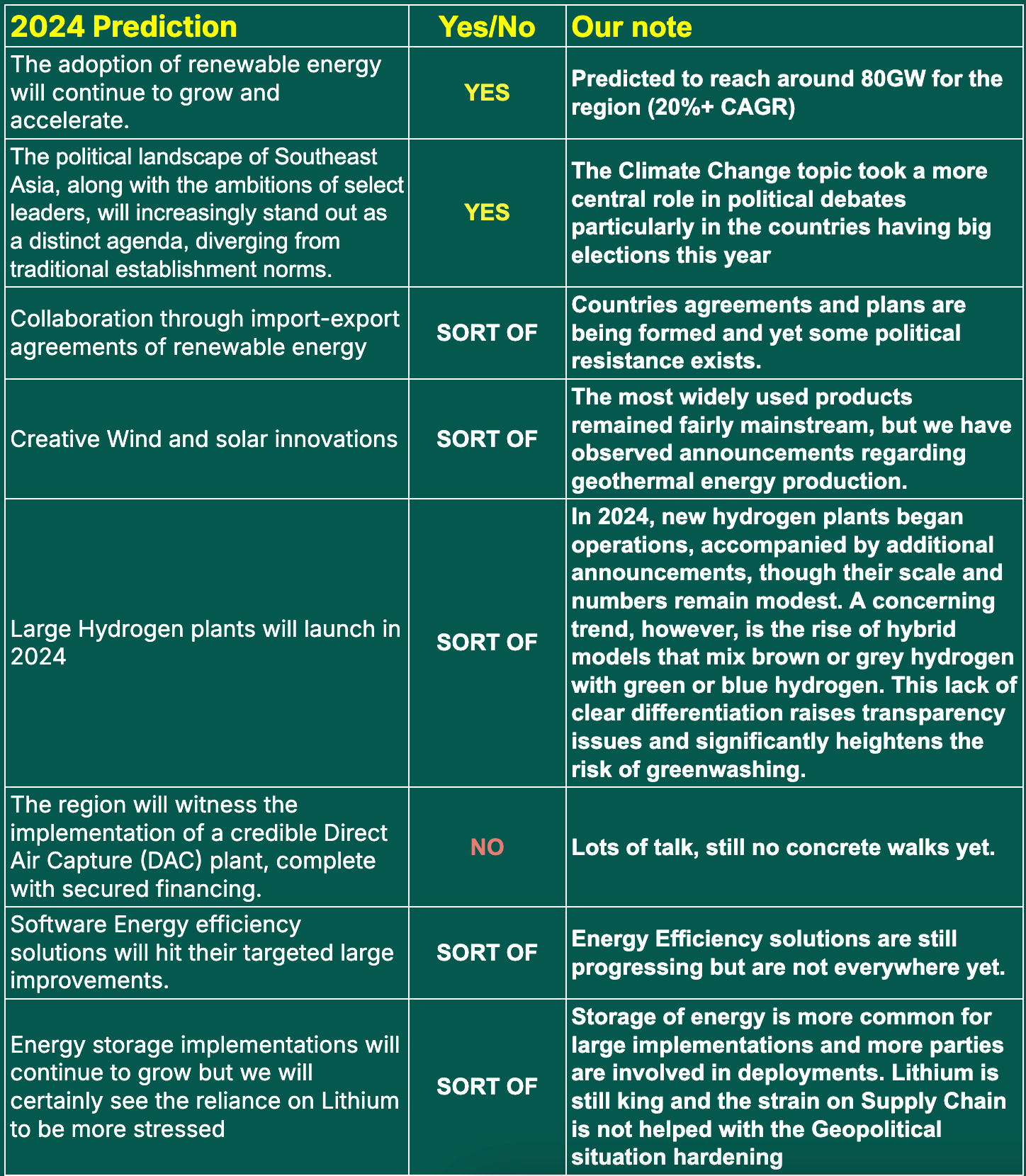

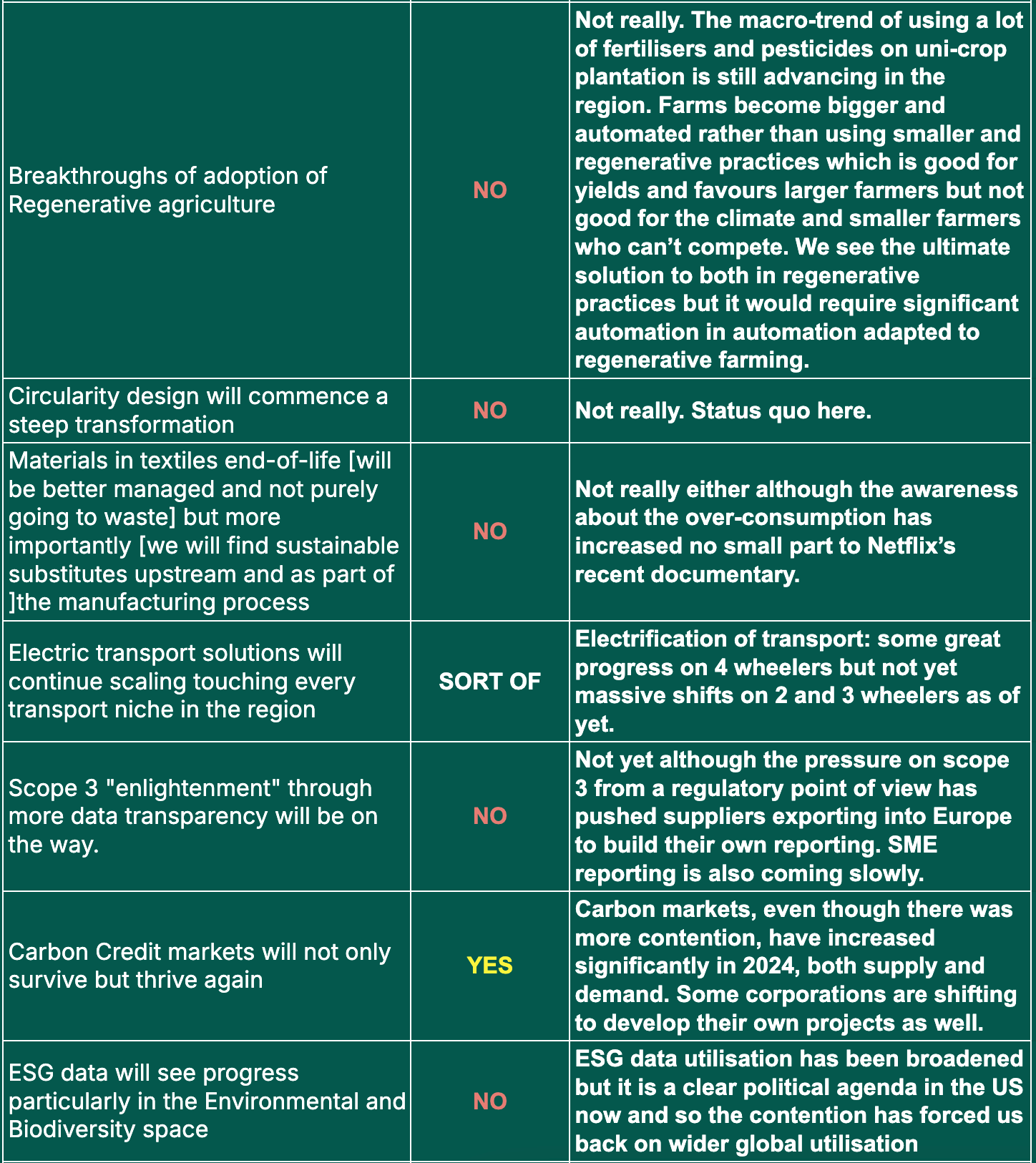

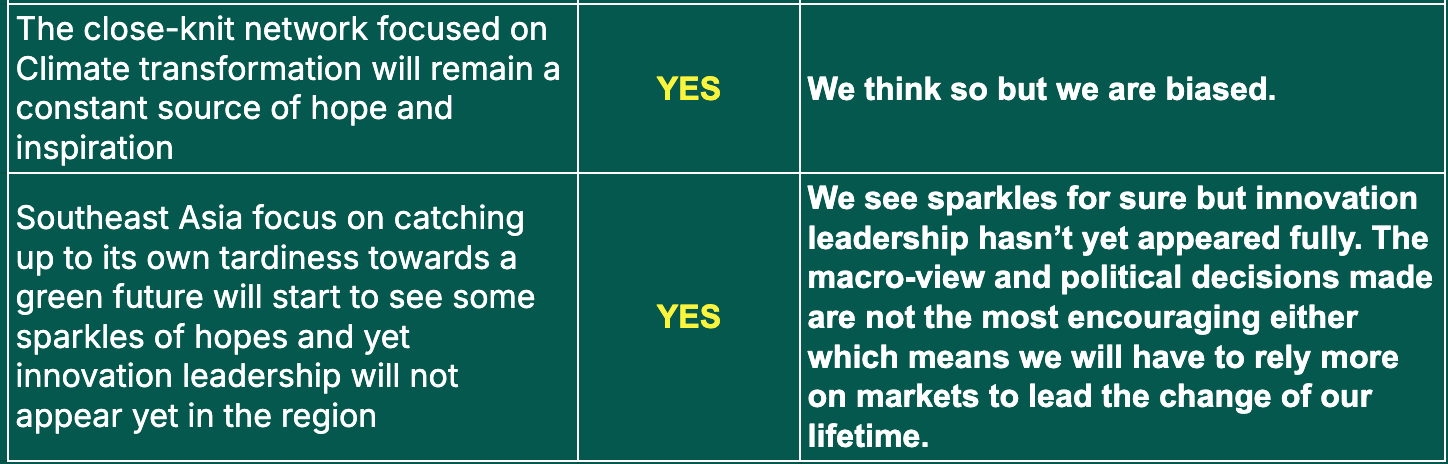

What did we get right and wrong in our 2024 predictions?

Last year, we predicted a few things, how did we do?

What we were encouraged by that happened in 2024 beyond the above

The unstoppable renewable deployment train is gaining more and more momentum

Rates of adoption are higher and getting faster. Vietnam's rate of renewable deployments is commendable this year.

EVs are hitting mainstream

Top selling cars in Southeast Asia include lots of EVs (BYD and Tesla leading the charge). Singapore’s EV market share will reach double digits next year.

60K+ 2 wheelers EVs on the road In Indonesia. Long way to go but it is an encouraging start and we see some similar slow movement in every Southeast Asia market.

Climate Policies globally and an unprecedented $300B climate deal for most exposed countries which is judged insufficient but demonstrates more momentum.

We were impressed by the commitment of the new Indonesian government to phase out coal faster than the initial commitment. 15 years is both an aggressive and an expensive target. The nay-sayer says it is too much of both, we like the commitment.

Carbon tax standards and agreement lead by Singapore but happening in most of Southeast Asia as well is showing a clear momentum.

The Philippines also increased their direct investment and commitments into the energy transition and climate agenda; showing up in the 2025 budget in a big way with an impressive 1T PHP to accelerate Climate Action and strengthen against disasters.

We see the emergence of Corporates (mainly privately owned) with a very aggressive transition plan and more importantly execution which clearly indicates leadership in the transformation which leaves the laggards at a difficult position owning potentially a lot of stranded assets.

We see more inclusion of biodiversity and Adaptation into the Climate agenda

A clear trend in the early stage funding of startups shows further climate deployments to be expected.

Some agnostic funds managed to raise in Climate (Intudo for example. And other agnostic early stage VC funds have been securing funding from Climate/Impact or DFIs with clear requirements to deploy in Climate).

But we still think the specialist funds have an edge as most are new markets for the existing funds to deploy into and they usually have propositions to deploy into software only.

New predictions for 2025

Policies

We will see Indonesia and Europe policies to counter-balance and hopefully find some equilibrium to get some benefits for Nature Based Projects and the Supply Chain for Indonesian products in the Old continent markets. Some background here: Euractiv

We believe that new subsidies for EV acceleration will hit the region and particularly Indonesia and hopefully creative ways to gain momentum in phasing out Coal.

Carbon Credit standards across the region will be more streamlined and hopefully we will see cross-border agreements for large project countries like Indonesia and Malaysia.

More global commitments and actions to curb methane emissions.

Renewables

We will see the first concrete plan for a pan-ASEAN grid infra including financing commitments being communicated (at least a few countries).

Our wishful thinking on that topic would see Indonesia connected to Singapore/Malaysia with clear large-powered energy cables.

Hydrogen and Ammonia will see more global collaborations and hopefully the emergence of a few use cases in the maritime and airline industries. Some more background here.

Transport

We will start to see the development of point-to-point ships using more sustainable sources of fuels, starting with biofuels, SAF and perhaps hybrid motors.

Carbon

Some new global reports will see the quality of projects improving showing that the contention was good in the long term and created more transparency for projects which ultimately reinforced the value proposition of NBS.

We will see the emergence of new Credit markets like for SAF and Plastic Credits

Land use

Some of the Palm Oil plantations reaching maturity will seek out better and more profitable usage of their land which offers opportunity for the agriculture, NBS and Energy sectors.

We will see or need to see us going faster, stronger and embrace risks for transformation

We, at Sif.vc, welcome the opportunity that the momentum of our shift towards a more sustainable future would mean to all of us.

We also applaud and cherish the industry’s approach of a community-based accelerating change to address the challenge of our lifetime. Join us and reach out!

Take care all,

@David Pardo for Sif.vc